Futures deficits and margin calls

When you trade futures, you're required to deposit a certain amount of money, which acts as collateral to open your position. As the value of your positions fluctuates, your account balance may drop below the margin requirement, which may lead to a futures margin call and an account deficit.

Account deficit

As your buying power fluctuates in real-time based on the open profit/loss of your futures position(s), you may experience a loss in the value of your position that causes your buying power to drop below zero. This means that the funds available in your account are below your margin requirement. If this happens, your account will be in a deficit, and you’ll need to deposit funds or close out positions to cover the deficit amount.

It's also possible for your positions to appreciate in value following an account deficit, which may cover the amount of applicable deficit. However, if you’re in an account deficit and the deficit amount isn’t covered, you may be issued a futures margin call and your futures position(s) is subject to liquidation.

Futures margin call

A futures margin call occurs when you maintain a futures position through the end of the trading day, but your account doesn't have enough funds to meet the margin requirement.

Futures margin calls are issued in the evening after the most recent trading session.

What happens if I'm issued a margin call?

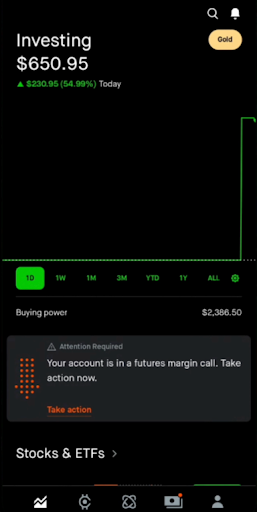

If you receive a margin call and action is required from you, you’ll receive an email, push notification, and in-app inbox message on day 1 informing you that you need to resolve the call.

If you don’t resolve the margin call the day it's issued, you’ll be issued a past due margin call the following day.

Past due margin call

If you receive a margin call that is left unresolved you’ll receive an additional email, push notification, and in-app inbox message on day 2 informing you that you’re in a past due margin call and need to resolve the call.

If you don’t resolve your past due margin call in a timely manner, Robinhood may have to liquidate your futures positions to cover your margin call.

If you’re in a past due margin call, your account will be restricted to futures position close only until the past due margin call is resolved.

How can I resolve a margin call?

You can resolve a futures margin call by:

- Depositing funds into your account

- Closing positions to increase your available cash

- The market increasing the value of your positions enough to fully satisfy the call

If you choose to deposit funds, it may take up to 1 business day to resolve the margin call, however these are typically resolved intraday.

If you decide to close positions to meet the call, you must make sure you end the trading day above your margin requirement. If you choose to open new positions and those new positions incur additional losses, your account may end the day below your margin requirement, and the call would remain uncovered.

If you’re relying on market appreciation to meet a futures margin call, any gains or losses will be marked to market based off of the daily settlement price of the contract. This gain or loss will determine if your position value increased enough to bring your account above the margin requirements to cover the call.

Daily settlement

Your futures margin call amount is based on the settlement price of your held positions at the time of daily settlement, which varies by product, not based on the price the market closes at.

Generally, the daily settlement times for each product in the below categories are as follows:

- Copper: 1 PM ET

- Silver: 1:25 PM ET

- Gold: 1:30 PM ET

- Energy: 2:30 PM ET

- Currency: 3 PM ET

- Crypto: 4 PM ET

- Stock Indexes: 4 PM ET

Holiday hours may vary. For a full list of hours check out the CME Group’s full holiday calendar.

How can I avoid a futures' margin call?

Generally, it’s best to focus on proper risk management and maintaining sufficient capital in your account. Check out what is futures margin to learn more.

Margin calls and buying power

It’s possible to be in a margin call and notice net positive buying power. This is because buying power is updated in real-time, whereas your margin call is based on the previous trade date's end-of-day balances. Generally, if your buying power is positive at the time of daily settlement for your positions (not market close), your margin call will be resolved due to market appreciation.

Disclosures

Futures, options on futures and cleared swaps trading involves significant risk and is not appropriate for everyone. Please carefully consider if it's appropriate for you in light of your personal financial circumstances.

Please read the Futures Risk Disclosure Statement prior to trading futures products, and please read the Event Contract Risk Disclosure for more information about the risks associated with forecast event contracts.

RHD accounts are not protected by the Securities Investor Protection Corporation (SIPC) and are not Federal Deposit Insurance Corporation (FDIC) insured. RHD is not a bank. Prior to trading virtual currency Futures products, please review the NFA Investor Advisory & CFTC Advisory providing more information on these potentially significant risks.

Futures, options on futures and cleared swaps trading is offered by Robinhood Derivatives, LLC, a registered futures commission merchant with the Commodity Futures Trading Commission (CFTC) and Member of National Futures Association (NFA).