How to read your 1099-B

For this tax year, you’ll get a Consolidated 1099 PDF from Robinhood Markets, Inc. It’ll include 1099 forms for Robinhood Securities, Robinhood Crypto, Robinhood Derivatives, and Robinhood Money, as applicable. Your 1099-B tax forms for Robinhood Markets, Inc. will show aggregated information for multiple transactions for the same security based on key criteria.

Also, any gains or losses from certain types of investments, including regulated futures contracts and non-equity options, will show in Section 1256 on Form 1099-B. This section is also known as the “Annual Report of Net Gain or Loss From Section 1256 Contracts.” These contracts are typically subject to what is also known as "mark-to-market" rules, which mean they’re treated as if they were sold at fair market value on the last business day of the tax year. As a result, any gains or losses are recognized for tax purposes, even if the contract is not actually sold.

This is for informational purposes only and aimed at answering questions regarding the tax document you may receive from Robinhood. We don’t provide tax advice. For specific questions, we recommend consulting a tax professional.

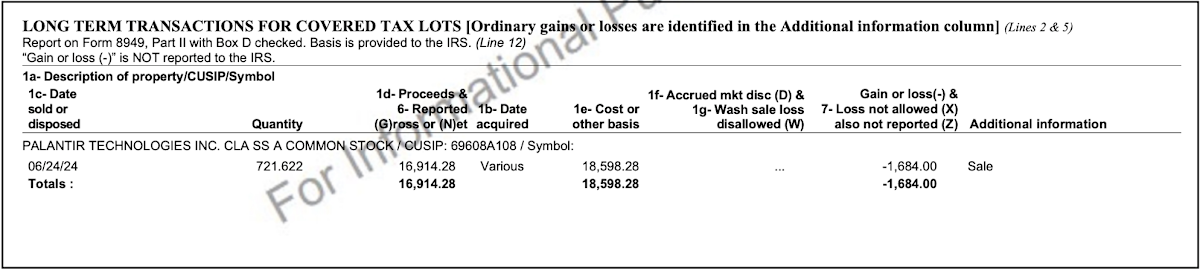

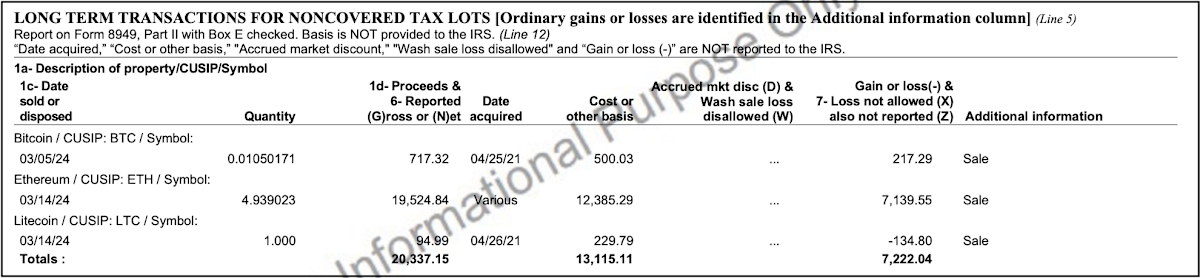

The following are examples of how multiple transactions for Robinhood Securities and Robinhood Crypto will now show as aggregated on a 1099-B:

- Quantity: Is the aggregated sale quantity for multiple sales in a single day for the same security or coin

- Date acquired: It’ll show as Various when a security sale applies to multiple transactions with the same term

- CUSIP: Is aggregated for a single security or coin, which is a 9-digit ID for security trades or a 6-letter ID for crypto trades

- Gain or loss: Is aggregated as the total gain or loss of all positions sold on a specific date

- Additional information: Shows how many transactions are included in the aggregated trade