How to read your 1099

For this tax year, you’ll get a Consolidated 1099 PDF from Robinhood Markets, Inc. It’ll include forms for Robinhood Securities, Robinhood Crypto, Robinhood Derivatives, and Robinhood Money, as applicable. 1099 tax forms for Robinhood Markets Inc. will also be displayed using an aggregated format based on key tax lot criteria.

Form 1099-R and 5498 aren’t included in this PDF and we’ll provide them separately. If you have joint investing account activity that requires a 1099, it’ll be provided separately from the consolidated 1099 for your individual account.

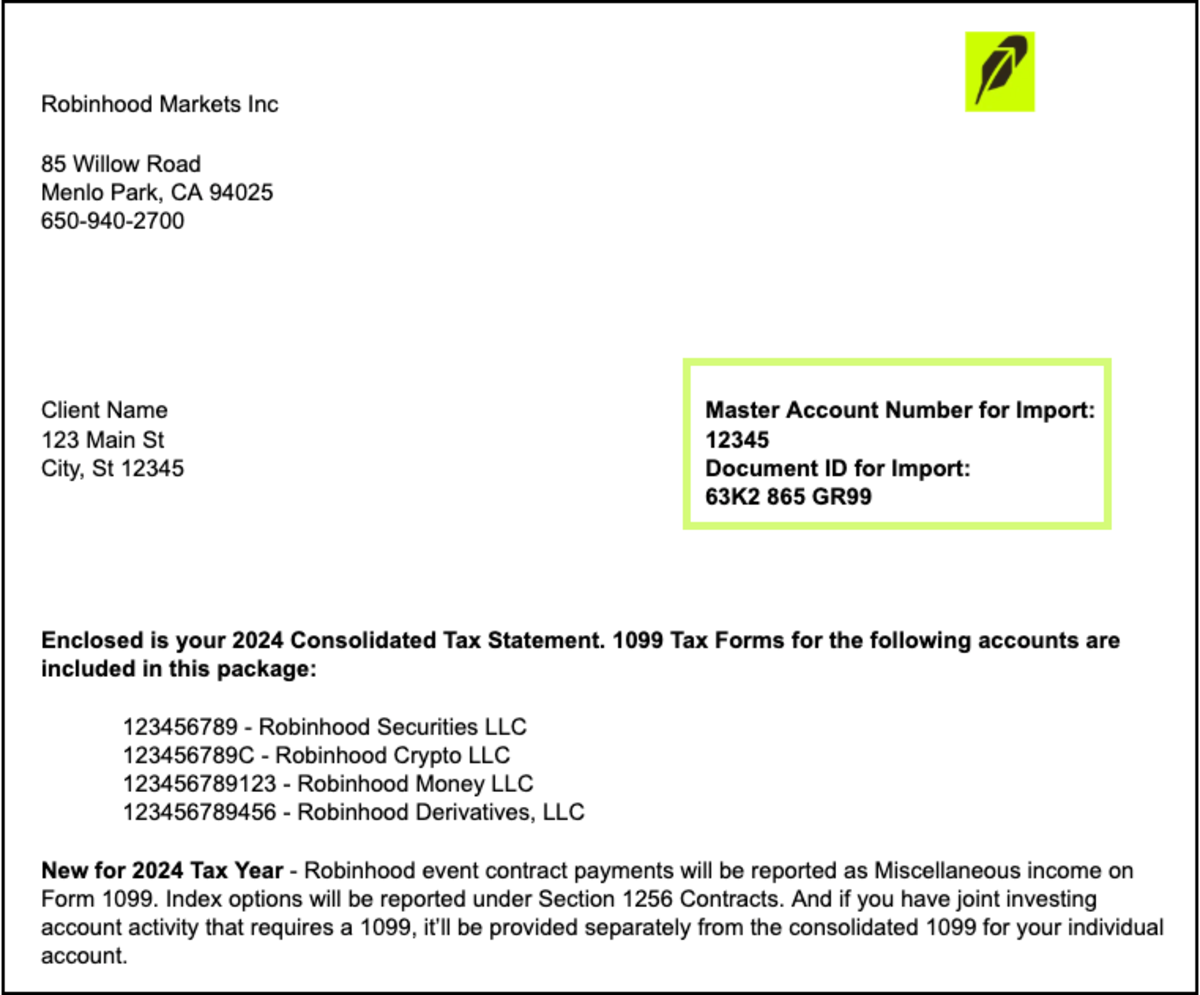

The following sample cover letter shows the master account number and the document ID. You’ll need these to import your 1099 into your tax software provider.

Also, check out How to import your 1099 to a tax provider and How to read your 1099-B.

This is for informational purposes only and aimed at answering questions regarding the tax document you may receive from Robinhood. We don’t provide tax advice. For specific questions, we recommend consulting a tax professional.

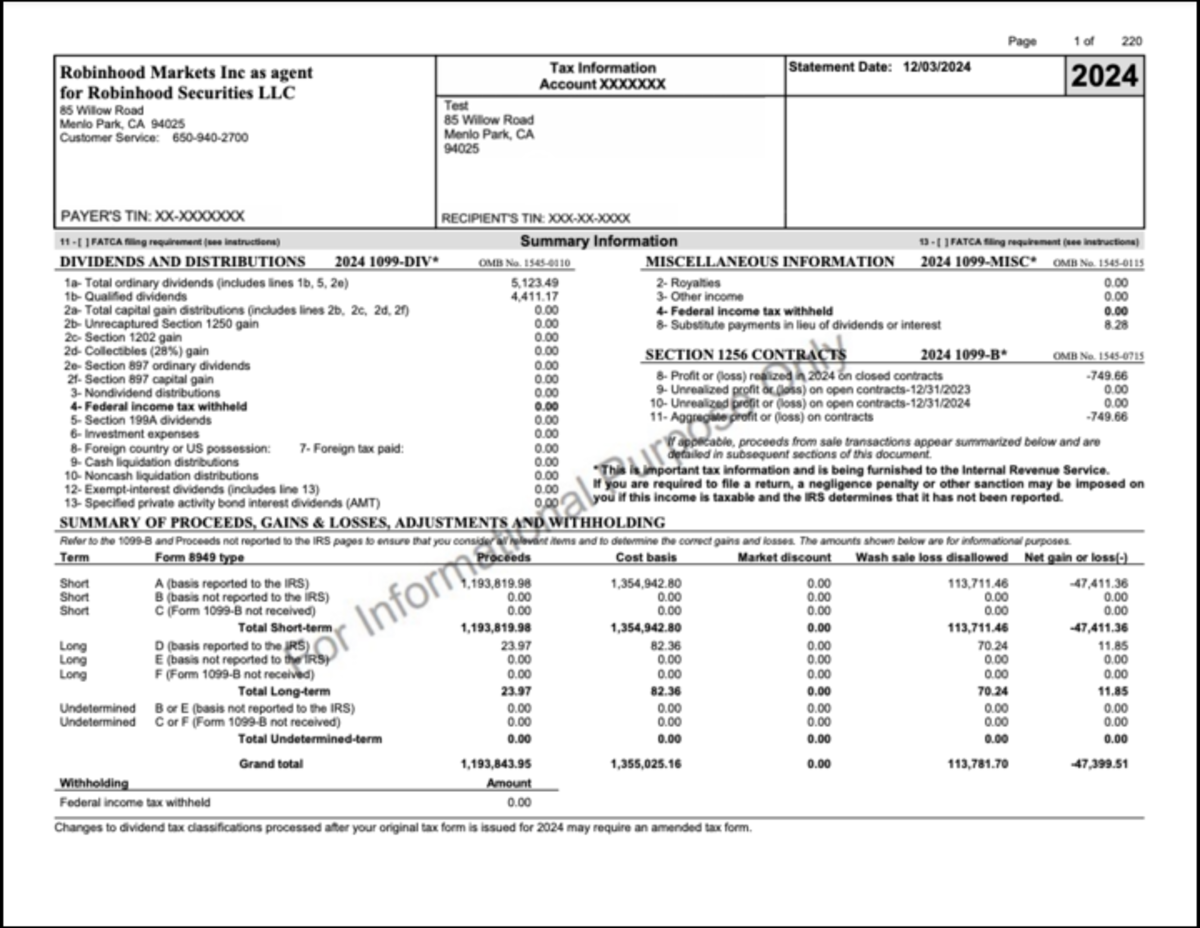

The following Form 1099 example includes the following key information:

- Robinhood’s address and taxpayer identification number (TIN)

- Your account information, including your account number, address, and TIN: You’ll need this information to import your 1099 into your tax software provider

- Dividends and distributions (IRS Form 1099-DIV): Includes income from any dividends or distributions from an investment during the year

- Miscellaneous income (IRS Form 1099-MISC): Includes any miscellaneous income during the year, such as referral bonuses or manufactured income

- Section 1256 Contracts: Includes the gains or losses from 1256 Contracts, including regulated futures contracts, index options, and other non-equity options.

- Summary of proceeds (IRS Form 1099-B): Short term refers to investments held for 1 year or less. Long term refers to investments held for more than 1 year

- Proceeds: The gross amount of money you received in exchange for selling positions within the year

- Cost basis: Your cost basis that may be subject to corporate actions or wash sales throughout the year

- Wash sales loss disallowed: The amount of realized losses that are subject to the IRS wash sale rule

- Net gain or loss: Total gain or loss of all positions sold during the tax year per Form 8949 category