Simulated Returns

You can use Robinhood’s Simulated Returns to analyze open options positions or those in your watchlist. This tool helps you visualize how your options returns could change over time and how movements in the underlying stock price can affect the value of an options contract or multi-legged options strategy. Exploring how different factors affect your returns can help you find a good time to exit.

The tool calculates returns based on the Bjerksund-Stensland model, which is a common options pricing model. It estimates the value of American options (options that can be exercised before expiration). In the tool, you’ll see both the estimated contract price and the simulated returns for a position.

Simulated returns are calculated by comparing the estimated contract price to the price of your contract when you opened it or added it to your watchlist. Returns also account for the quantity of a position.

The tool uses the following information to simulate returns.

- The underlying stock price: Defaults to the current price for when you open the tool. You can adjust the price with the slider below the chart.

- Strike price: Defined by the options contract or strategy.

- Time until expiration: Also defined by the options contract or strategy. You can use the graph to evaluate the effect of time decay on your position.

- Implied volatility: Calculates the current implied volatility based on the option’s market price.

- Risk-free interest rate: Uses the interest rate of a treasury bond with a term similar to the time left on the option.

This model doesn’t account for dividends or regulatory fees. The impact of fees on your returns can be greater for lower-priced options.

Limitations

The tool’s model assumes the implied volatility and risk-free interest rate will stay the same. However, changes to these factors can affect the price of your options. For example, implied volatility can change significantly over time, especially around earnings.

Both factors are set when you open the tool, and won’t dynamically update while it’s open.

How-to steps

You can simulate the returns of an open options position or one that’s in your watchlist. You can analyze both single- and multi-leg positions.

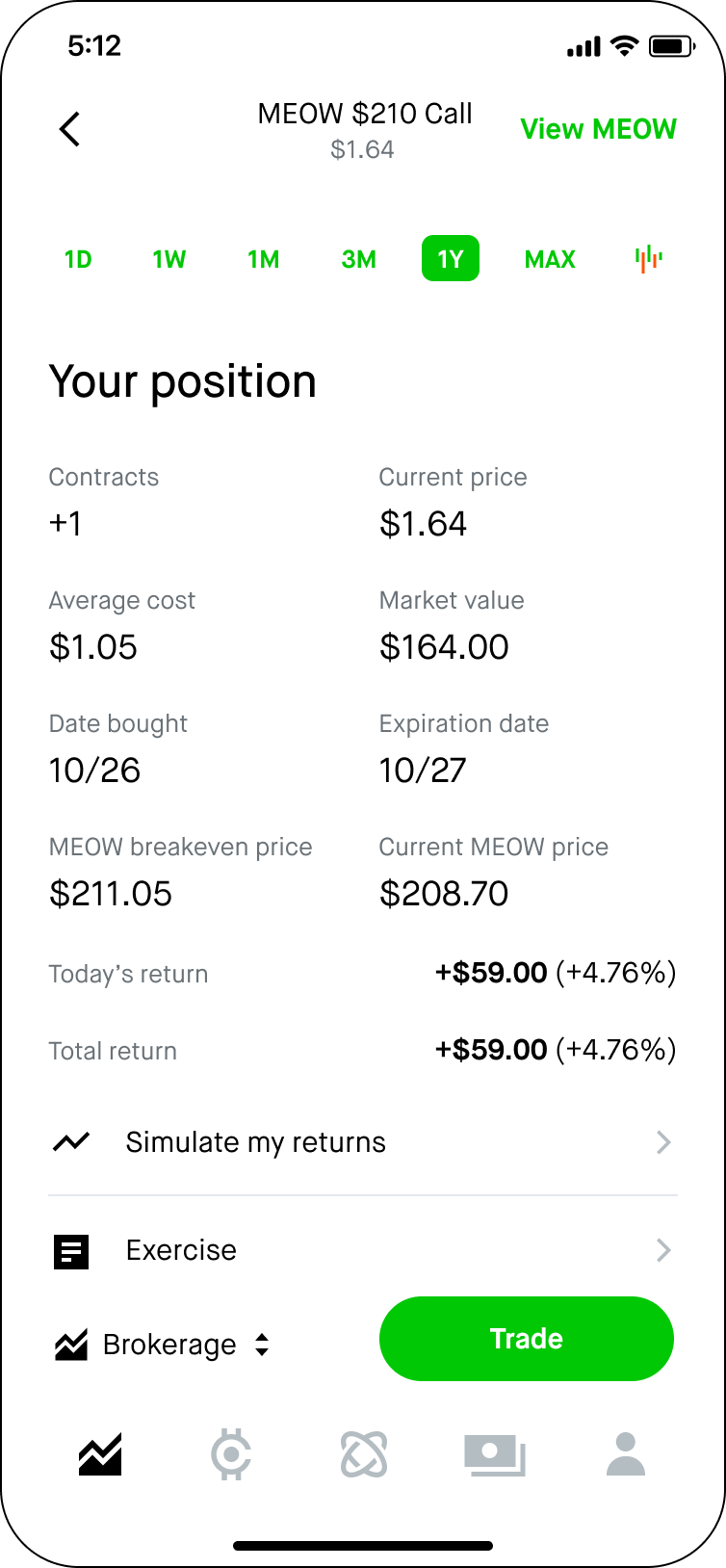

- Go to an options detail page, and then select Simulate my returns

- Adjust the price dial below the chart to see how changes in the underlying stock price can affect your returns

- Drag your finger (in the app) or cursor (on the web) in the chart to evaluate how your returns can change over time

- To switch between price and percentage returns, select the double-arrow button next to the price

Disclosures

Robinhood’s Simulated Returns tool doesn’t display actual returns, but possible returns based on the effects of stock movement and time decay. The results shown in this tool are hypothetical and only as accurate as the tool’s model and inputs. This tool may lead to inaccurate conclusions due to insufficient or incorrect variables, incorrect assumptions, and accuracy of source data. Although this tool can help you make investment decisions, it doesn’t reflect actual investment results or guarantees of future results.

Be aware of the risks associated with your specific options strategy, as options trading and certain options strategies are not appropriate for all investors. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. To learn more about the risks associated with options, read the Characteristics and Risks of Standardized Options before you begin trading options.

Because of the importance of tax considerations to all options transactions, consult your tax advisor about how taxes affect the outcome of each options strategy. Also be aware of the risks listed in Day Trading Risk Disclosure Statement and FINRA Investor Information. Examples included in this article are for illustrative purposes only.